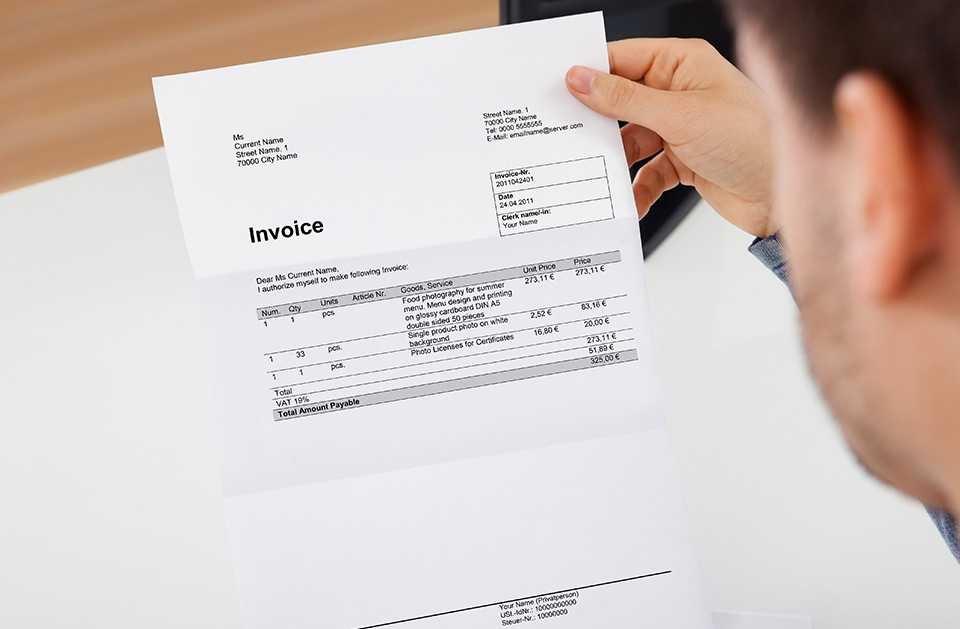

No matter what sort of deal it is. A receipt is provided if you pay a fee with cash or a credit card. Bank transactions follow the same rules. Any engagement you have with a bank should result in a receipt.

A Bank Receipt: What Is It?

Banks handle large sums of money. They were made specifically to do this. They thus require systems for monitoring transactions. The majority of banks have a variety of records that support recordkeeping. A bank deposit slip would be one illustration of this. It keeps track of information about a bank deposit. Banks also give their clients receipts, much like the deposit slip. You must be aware of how to check the fake transfer or slip (สลิป โอน เงิน ปลอม, which is the term in Thai) to avoid any fraud.

Every time a transaction occurs, clients are given a bank receipt. They keep detailed records of all interactions between the consumer and the bank. They are provided to consumers as evidence that the transaction happened. Banks advise their clients to save copies of their bank receipts for their records.

What Kinds Of Information Are On A Bank Receipt?

Your bank receipts include a wealth of information you’ll find when you examine them. This information relates to the contested transaction. Every transaction will often result in the issuance of a new receipt. The majority, if not all, of the following information, may be found on a bank receipt:

- The account holder’s name

- The number for the bank account

- How the transaction was made (deposit, withdrawal, transfer, etc.)

- The transaction’s amount

- The transaction’s timing and date

- Your bank’s employee who helped you, by name

Saving Individual Bank Receipts

For personal financial needs, keeping receipts provides several advantages. Additionally, it enables you to preserve documentation of the actual transaction. If any funds are missing from an account, this might assist you in resolving any issues.

Banks also advise clients to use saved receipts to reconcile their accounts at least once each month. This applies to both bank transactions and payment receipts. The most excellent method to manage your funds is to do it this way.

Conclusion

Any company owner will tell you how important it is to maintain bank receipts. It enables improved accounting. If significant sums of money disappear, it also offers a dispute mechanism. As a company owner, the issue with collecting actual receipts or slip verification is how rapidly they accumulate. Businesses frequently interact with banks, which might result in numerous bank errors.