Buying a car is a significant financial commitment, but the true cost of ownership goes far beyond the purchase price. Many overlook hidden expenses such as insurance, maintenance, and depreciation, which can substantially impact their budgets. Whether you’re researching the Tata Motors share price for a potential investment or consulting with a SEBI-registered advisor for financial planning, understanding the total cost of car ownership is essential to making an informed decision.

1. Insurance Costs

Insurance is a mandatory expense that varies based on factors like the car’s make and model, your driving history, and location. Premiums for luxury or high-performance vehicles are typically higher than for standard models. Comparing insurance quotes before purchasing a car can help you estimate and plan for this recurring cost.

2. Fuel and Energy Expenses

Fuel is one of the most noticeable recurring costs of car ownership. Fuel efficiency varies widely among vehicles, so consider the car’s mileage rating to calculate ongoing expenses. With the rise of electric vehicles (EVs), energy costs like home charging station installation and electricity usage have become a consideration for many buyers.

3. Maintenance and Repairs

All cars require routine maintenance, including oil changes, tire rotations, and brake replacements. Luxury or imported vehicles often have higher maintenance costs due to specialized parts and servicing. Extended warranties or service packages can help manage these expenses, but they come with their own costs.

4. Depreciation

Depreciation is one of the most significant and often overlooked costs of owning a car. On average, a car loses about 20-30% of its value in the first year alone. Certain brands and models retain their value better than others, so researching resale values can help you make a smarter choice.

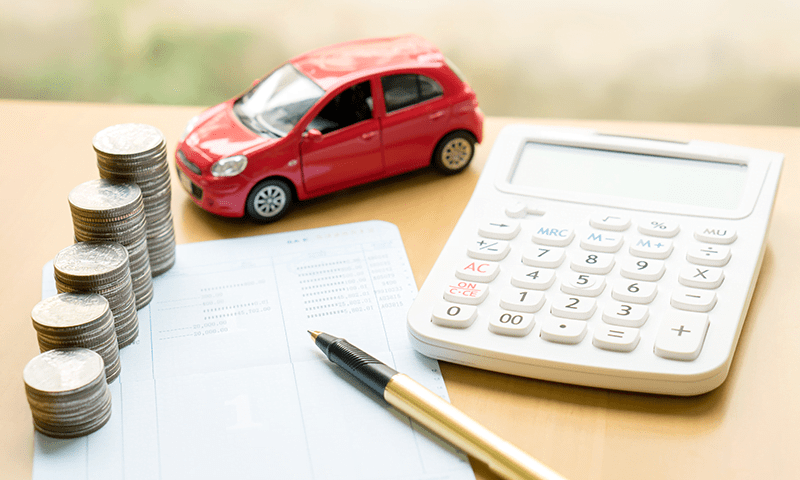

5. Loan Interest

If you finance your car, interest on the loan adds to its total cost. The interest rate depends on your credit score, loan term, and lender. Opting for a shorter loan term can reduce the total interest paid, even though it increases monthly payments.

6. Taxes and Registration Fees

One-time expenses like sales tax and registration fees can add up. These costs vary by state or region and are typically based on the car’s value. Be sure to include these in your budget when calculating the total cost of ownership.

7. Parking and Tolls

If you live in a city or frequently use toll roads, parking fees and tolls can significantly impact your budget. Monthly parking in urban areas can cost hundreds, while tolls add up quickly for commuters.

8. Customization and Add-Ons

Aftermarket modifications or add-ons like custom rims, advanced sound systems, or upgraded interior features are enticing but can inflate your car’s cost. Additionally, some customizations may increase insurance premiums or void warranties.

9. Opportunity Cost

The money spent on a car could have been invested elsewhere. If you’re monitoring the Tata Motors share price and working with a SEBI-registered advisor, you might consider how much potential growth you’re sacrificing by allocating funds to car ownership instead of investments.

Conclusion

Owning a car is a long-term financial commitment that requires careful planning. Beyond the initial purchase price, consider factors like insurance, fuel, maintenance, and depreciation to understand the true cost. By evaluating these expenses upfront, you can avoid financial surprises and ensure your car fits comfortably into your budget. For guidance on managing your finances or balancing investments alongside significant purchases, consulting a SEBI-registered advisor can provide clarity and direction. Whether you’re eyeing models tied to the Tata Motors share price or exploring other brands, a holistic approach will ensure a smarter financial decision.